This article originally appeared in PolicyTracker.

Defense ministries around the world control a significant amount of the spectrum. Thanks to advances in spectrum sharing, there is an opportunity to share some of these frequencies with commercial users, particularly from the mobile industry. But are defense users willing allies?

by Richard Handford

Policymakers are looking more keenly at how governments use spectrum, with an eye to promoting greater spectral efficiency.

There is also an effort among government and regulators to identify more mid-band spectrum for IMT, 5G in particular.

Traditionally, defense users have been unwilling to give up or share their frequencies

Defense departments are typically the largest holders of radio frequencies in government. For example, Australia’s Department of Defense holds more frequencies than all other government users put together and even has its own spectrum office to coordinate usage by the armed forces and the department itself.

In addition, a significant amount of defense’s access to radio frequencies in Australia is authorized under its own apparatus licenses which cover certain bands footnoted in Australia’s Table of Frequency Band Allocations. These are often termed “Defense bands”.

A similar approach is true of other countries. In India, for instance, a significant number of bands have been identified for the exclusive use of the armed forces. They are also described as “defense bands”.

Whatever the country, the armed forces have a particular usage pattern that can combine intense activity with lower demand or even absence from the airwaves at certain times.

Traditionally, defense users have been unwilling to give up or share their frequencies. And the primacy of national security has trumped any suggestion that spectrum should be conceded to the civilian sector.

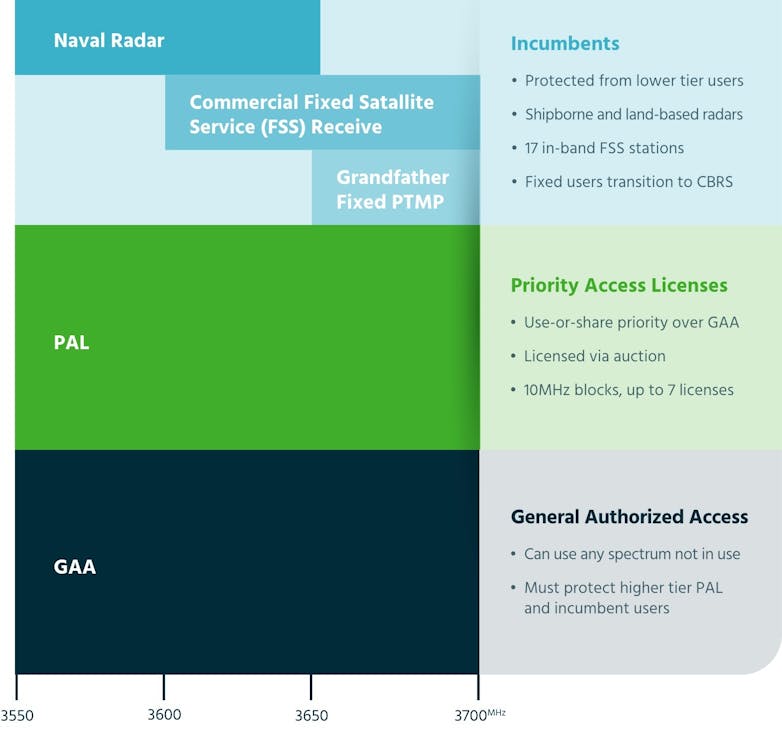

The debate shifted with the 2020 launch of the Citizens Broadband Radio Service (CBRS) in the US. The CBRS is a dynamic shared access (DSA) system that operates in the 3.5 GHz band (3550—3700 MHz) and accommodates US Navy radar alongside commercial users.

The CIO of the DoD says the armed forces can share frequencies without compromising national security

The CBRS showed coexistence between federal and private users was possible through a system that protects defense users while enabling commercial IMT service. Dynamic sharing has emerged as a preferable mechanism, at least for defense users, to segmenting or relocating incumbents, both of which have been deemed too expensive and time-consuming.

Other initiatives in the US between the defense sector, the regulator (the Federal Communications Commission (FCC)) and commercial users indicate the CBRS is not a one-off (see Figure 1).

In 2022, the US Department of Defense’s (DoD) chief information officer John Sherman said it was possible for the armed forces to share frequencies without compromising national security.

Vacating the 3100—3450 MHz band would take decades and cost the DoD billions of dollars. “But sharing offers us a way ahead out of this and we’ve proven we can do this with the other initiatives I’ve talked about,” he said.

The CTIA, the trade association representing the US mobile industry, has argued that some or all of 3100—3450 MHz should be reallocated exclusively for IMT rather than shared with the armed forces.

CBRS offers reassurance to defense users

The AFC system proposed for 6 GHz and the one used in the SAS have some similarities

The CBRS has pioneered a certain model of dynamic spectrum sharing that offers reassurance to defense users. Access is via a spectrum access system (SAS), a database that manages allocation for commercial users as well as protecting incumbents. The system is multi-tiered.

As an additional protection, the CBRS boasts a system of sensors, called the environmental sensing capability (ESC) network, which detects any US Navy usage. The ESC sensors alert the SAS, which activates a dynamic protection area (DPA) that displaces commercial users if required. The DPAs extend 200 kilometres inland.

The ESC network is necessary because the US Navy does not share the position of its ships for security reasons so the location of its radar systems has to be independently established.

This means the CBRS is more complex than, for instance, the sharing associated with unlicensed access in the 6 GHz band in the US which does not need to protect defense users.

The automated frequency coordination (AFC) system proposed for 6 GHz and the one used in the SAS have some similarities. They both rely on the same underlying principles. Firstly, they take inputs gathered from sources such as a database, portal, or sensor.

Both systems then feed the inputs through a set of rules established to protect incumbents and offer availability to entrants according to a number of conditions including location and power level.

Like in the US, AFC systems that work in unlicensed frequencies in 6 GHz are not yet commercially available in Canada

However, there are differences in how the rules are set in the two systems. While AFC makes single-entry calculations, the SAS calculations are made on an aggregate basis with input from other SAS systems—a stricter approach.

Similarly, new commercial devices on an AFC system will check in for channel availability updates once a day, while on the SAS, the check-in is much more frequent—every five minutes—so the new devices can be moved if the Navy starts using spectrum.

The wider CBRS system is also distinct from unlicensed usage in 6 GHz because it is multi-tiered and supports a network of sensors, as previously mentioned.

The incumbents in the 6 GHz band will typically be static microwave links with no national security consideration, unlike the US Navy ships which are on the move and do not share their location, thereby adding a layer of complexity to CBRS that is absent from the 6 GHz band.

Having made this general observation about 6 GHz, it is worth noting that an exception exists in Canada where some point-to-point links in the band will not be made public in the sharing database because they relate to national security. Instead, the information is shared with certified database managers who conform to agreed security protocols. Such an approach could potentially be used elsewhere where there is a sensitive (yet static) setup.

The CBRS dynamic spectrum sharing system requires all three parties—military incumbents, licensing authority, and dynamic system management operator—to be in coordination together

Like in the US, AFC systems that work in unlicensed frequencies in 6 GHz are not yet commercially available in Canada.

“In the case of CBRS, we have been authorized by the FCC to act on its behalf as a SAS administrator to make spectrum assignments,” says Jennifer McCarthy, VP of Legal Advocacy at Federated Wireless, a private wireless and shared spectrum services provider. “We interface with the FCC’s licensing database (ULS) to make sure we correctly identify entities licensed by the FCC to operate in the CBRS band. We also interface with the FCC’s equipment authorization system (EAS) database to identify equipment that’s been certified for operation in the CBRS band.”

To protect incumbents from new commercial operations in the CBRS band, Federated Wireless acquires information about military spectrum usage through different methods. “One way is via a network of sensors along the US coastlines that listen for shipborne military radars,” says McCarthy. “Then there is an online scheduling portal that’s used when the military knows in advance of their usage at certain fixed locations. Or thirdly, we have more static sharing approaches around certain military bases. The CBRS dynamic spectrum sharing system requires all three parties—military incumbents, licensing authority, and dynamic system management operator—to be in coordination together.”

McCarthy coins the phrase “dynamic spectrum management system” (DSMS), which originated in discussions about sharing possibilities in the 3100—3450 MHz band, to cover the diversity of sharing options now available. In some situations, a system could be closer to the AFC that’s been designed for sharing in the 6 GHz band, while in others it could be more like SAS depending on the incumbent systems in the band, how frequently they operate, and other considerations. The use of the term DSMS reflects the diverse options for a sharing regime with a military incumbent.

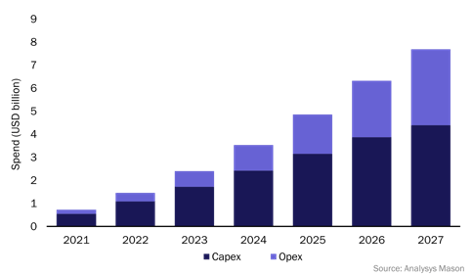

A report by the US National Telecommunications and Information Administration (NTIA) found that the number of devices on the CBRS had grown by 121 per cent in the 21 months from 1 April 2021, to 1 January 2023. The NTIA also found that about 45 per cent of all active CBRS devices were deployed where the use of spectrum is shared with defense users—an indication that the sharing regime is working.

Of course, one prerequisite for the defense sector sharing spectrum is the wider adoption of AFC or SAS sharing regimes in a country. Implementation globally is still at an early stage. The US and Canada are leaders in the field. CBRS is currently the only dynamic spectrum-sharing system that is commercially available in the world.

Will other countries follow the US lead?

Ofcom says it is currently updating its spectrum licensing software to a single, unified system

The UK national regulatory authority Ofcom has not introduced dynamic spectrum access. It still relies on a manual rather than an automated approach to spectrum sharing, whereby interested parties apply to use shared spectrum and wait for Ofcom to manually coordinate their request, rather than the automated system through a database.

In March 2023 it published a review of its shared access regime. “Based on… discussions with stakeholders (where there was no consensus view) and our analysis of costs and benefits, … [DSA] is not our preferred approach for these bands at this time,” it concluded.

Yet among its recommendations, the regulator said it had been working with the UK’s Ministry of Defense (MoD) to see if more of the 2.3 GHz band (specifically 2300—2350 MHz) could be made available for low power use under the shared access framework. The 2390—2400 MHz band is currently available on a shared basis.

More optimistically for supporters of DSA, the UK regulator also published a review of dynamic or adaptive spectrum management alongside its review of the shared access framework.

In that document, Ofcom says it is currently updating its spectrum licensing software to a single, unified system under its licensing platform evolution (LPE) programme. This is intended to be far more automated.

Some licenses, including shared access ones, will move to the new platform in early 2024. Ofcom says the new system “has the potential to provide a platform for, and act as a springboard to, more dynamic spectrum management solutions”.

In Australia, the Department of Defense’s spectrum office has been skeptical about the possibility of sharing its radio frequencies with commercial users in the past.

The UK regulator asked the defence ministry to review its use of 7—24 GHz

In response to a consultation on sharing launched by ACMA, the country’s regulator, the defense spectrum office contrasted the CBRS, “which puts the burden of sharing on Tier 2/3 (secondary) users,” with the “simplified sharing framework proposed by ACMA”. It said there were “numerous practical, technical and security issues with such an approach that make it problematic. Defense does not support such a model.”

PolicyTracker asked the defense spectrum office if it would take a more positive view of a CBRS-type model and whether its views had changed in the intervening four years. We have received no response so far.

PolicyTracker also contacted the UK’s Ministry of Defence (MoD) for its view. We were directed to a slide deck shared by an MoD speaker at Tech UK’s Future Spectrum Policy Summit held in December 2022.

The slides related to potential sharing in the 7—24 GHz band. Ofcom asked MoD to review its usage of these bands. The MoD says that 85 per cent of its spectrum (not just 7—24 GHz) is already shared with other public or private sector users (although not dynamically).

The 7-24 GHz band is extensively used by defense users. The MoD also points out that sharing incurs additional costs. And said it is running out of spectrum.

The MoD concludes: “Alternative modes of sharing, such as adaptive spectrum access (ASA), could produce economic opportunities for increased access to public sector frequency bands but we are not there yet.”

Figure 1: Spectrum sharing initiatives in the US between DoD and commercial users

| Spectrum Band |

Name |

Incumbent |

Arrangement |

Status |

| 3550—3700 MHz |

Citizens Broadband Radio Service (CBRS) |

US Navy radar systems |

Dynamic sharing access sharing. commercial launch in early 2020. |

Auction raises $4.58 billion raised (August 2020). Commercial launch in early 2020 |

| 3450—3550 MHz |

America’s Mid-Band Initiative Team (AMBIT) |

Majority of DoD users relocated with some remaining |

Not a sharing regime. Remaining DoD users in specific locations protected through coordination arrangements. |

Auction raised $22.5 billion (January 2022) |

| 3110—3450 MHz |

Partnering To Advance Trusted and Holistic Spectrum Solution (PATHSS) |

Radar systems |

Dynamic spectrum management system. Still under discussion. |

DoD is due to report by 30 June 2023. |

| Lower 37 GHz (37.0—37.6 GHz) |

n/a |

Military will have access to spectrum in specific locations. Coordination required on occasion. |

The FCC has established a licensing framework for sharing in this band. |

The FCC is developing service rules under a pending proceeding. |

| 2025—2110 MHz |

n/a |

Broadcasting |

Military will have access to spectrum in specific locations. Coordination required on occasion. |

MoU signed between DoD, NAB and SBE |

Source: PolicyTracker

© PolicyTracker 2023, a Research Note available as part of the Spectrum Research Service